Miami Real Estate Investment: Is Miami a Good Place To Invest?

- Miami Real Estate Investment: Is Miami a Good Place To Invest?

Miami Real Estate Investment: Is Miami A Good Place To Invest?

Successfully investing in real estate — whether you are in Miami or anywhere else in the world — is all about correctly timing the market. Knowing when to enter the real estate market can often be a bit of a challenge. Is Miami a Good Place For Real Estate Investment? Many real estate investors have asked themselves if buying a property in Miami is a good investment.

Miami is a fairly walkable city in Miami-Dade County. Miami hits most people’s radar as a tourist destination, though it periodically hits the news when it looks like it may be hit by a hurricane. However, Miami is a large, thriving city with a strong housing market. Miami is home to just under half a million people.

However, the Miami housing market is far larger than that – it includes much of southeast Florida and more than five million people. That makes the Miami real estate market the seventh-largest in the U.S., and it is the second-largest housing market in the southeastern U.S. Miami Real Estate’s Strong In-Migration & Other Market Fundamentals Make It a Great Place To Invest in Real Estate.

Top Reasons To Invest In The Miami Real Estate Market? | |

Source: MIAMI Association of Realtors® | |

Although, this article alone is not a comprehensive source to make a final investment decision for Miami we have collected ten evidence-based positive things for those who are keen to invest in the Miami real estate market. Investing in Miami real estate will fetch you good returns in the long term as the home prices in Miami have been trending up year over year. Let’s now discuss the state of the Miami real estate market, which can help investors who are keen to buy an investment property in this city.

Relatively Affordable Market for Investors

Miami-Fort Lauderdale-West Palm Beach’s median home price ($570,000) is significantly lower than many other major markets such as San Francisco-Oakland-Hayward, CA ($1.3 million), San Diego-Carlsbad, CA ($900,000), Los Angeles-Long Beach-Glendale, CA ($893,200), Seattle-Tacoma-Bellevue, WA ($741,300), Boston-Cambridge-Newton, MA-NH ($698,900), Denver-Aurora-Lakewood, CO ($666,000), New York-Jersey City-White Plains, NY-NJ ($616,300), and Washington-Arlington-Alexandria, DC-VA-MD-WV ($581,300), according to NAR’s Q3 2022 Metropolitan Media Area Prices report.

Miami is a Strong International Market

In 2011, nearly a third of residents were foreign-born. However, about half of those become citizens, so we can say that Miami is simply considered attractive to immigrants. However, the Miami housing market is unusual in the number of foreigners buying homes here. Russians, Brazilians, Argentines, Turks, Chinese, and British buyers are buying up properties here at a far higher rate than would be expected. Some see the property purchases as a safe investment, while others intend to use the beachside condos as vacation properties.

A few bought homes in Miami to flee to in case their home countries became untenable, which explains the large Venezuelan ex-pat community in Miami. Many tourists come to the beach, and many people want to live there, as well. Miami’s beaches are made all the more attractive by the year-round subtropical weather. This helps explain why Miami-Dade’s population is growing around 2% a year while south Florida’s population overall has been stagnant. It is considered the fifth fastest-growing region in the U.S.

It is #1 among the major U.S. Destinations for Foreign Buyers. Florida has been #1 for 10 Years for Top US Markets for International Traffic. The Miami real estate market does present an opportunity for those who want to cater to tourists. The Port of Miami is known as the Cruise Capital of the World since it is the top cruise passenger port in the world. Landlords can rent to tourists who want to stay for a week in Miami before flying home or simply want to enjoy Miami’s beaches, cultural activities, and sports teams.

The Geographic Constraints

Many of the world’s fastest-appreciating real estate markets are attracting people coming for work and quality of life, but they cannot expand the housing supply to meet demand. San Francisco is surrounded by water on three sides, and they make things worse by limiting the height of buildings, so they can’t build up the way NYC has. In Colorado and Utah, a mix of federal parklands and vertical mountains limit where developers can build houses.

We’ve already mentioned that Miami is on the water. Miami has experienced a spurt in high-rise construction in downtown, giving it the third-highest skyline in the U.S., but other areas limit it so that high rises don’t block the view of the water. However, that hasn’t prevented the Miami real estate market from becoming the sixth densest housing market in the U.S. overall.

There’s an interesting factor to consider in the Florida housing market, and that’s the massive retiree population. Many older people move to Florida for the mild weather, and they’re rather immune to housing price fluctuations. Older people who already live here stay in their homes. This results in fewer turnovers in the Miami real estate market, limiting supply for would-be buyers.

That explains why Tampa and Coral remain over-priced markets though jobs aren’t as plentiful there. Retirees who do leave the state periodically tend to keep their Florida home as a second residence instead of selling it. The Gulf Coast is more of a vacation spot than a retirement enclave, so there’s less competition for limited housing stock.

Miami’s Economy Development and Job Growth

Many people move to Miami for work. Miami is the largest urban economy in Florida, and it has the 12th largest GDP in the U.S. The World Cities Study Group classified Miami as an alpha city based on the level of business activity, human capital, and cultural activity. The unemployment rate in Miami hovers around 4% (before COVID-19); it is currently in line with the national average but often below it. Only Orlando has a better job market.

Miami-Dade County is a global tourist destination. Since 2011, overnight visitors to Miami-Dade have increased by 20 percent, and hotel room nights sold have gone up 22 percent. In 2019, Greater Miami welcomed 24.3 million visitors, an increase of 4.6 percent over 2018. Travel and tourism fueled a record-breaking 146,700 jobs in 2019. While MIA, PortMiami, and tourism are driving forces in the local economy, Miami-Dade has a vibrant entrepreneurial spirit among small businesses.

The Kauffman Foundation regularly ranks Miami as the top U.S. city for startup activity. For those residents in the County who are homeowners, life has also improved dramatically in the past eight years. County’s government’s one promising project on the drawing board is the Redland Market Village, which will create a vibrant downtown destination in south Dade. This project will bring 2,600 jobs and $351 million to the community during construction. Once complete, it will generate an annual economic impact of $40 million, and more than 400 new jobs, in addition to the 800 currently there.

According to a new report from the University of Central Florida’s Institute for Economic Forecasting, from 2022 to 2025, Florida’s economy, as measured by Real Gross State Product, will expand at an annual rate of 3.%. After contracting by 2.8% in 2020, Real Gross State Product rose by 6.9% in 2021.

Payroll job growth in Florida will continue to outpace national job growth as the labor market climbs out of a steep decline. After year-over-year growth of -5.2% in 2020, the labor market rebounded by 2.6% in 2021, with growth expected to be 5.1% in 2022, 2.3% in 2023, 1.5% in 2024, and 1.2% in 2025. Average job growth in Florida over the 2021-2024 period will be 0.8 percentage points faster than the national economy.

The efforts to lower the state’s unemployment rate will continue and Florida’s accelerating job creation will help. The unemployment rate jumped from 3.3% in 2019 to 7.9% in 2020, fell to 4.8% in 2021, and will fall to 3.8% in 2022 and to 3.5% in 2023, before rising to 3.9% in 2025.

Housing starts will pick up going forward, but not nearly fast enough to offset the large shortage of single-family housing in the short run. The total starts of 156,762 in 2020 jumped to 190,061 in 2021 but will ease to 182,663 in 2022, to 162,425 in 2023, to 156,911 in 2024, and tick up to 157,178 in 2025. House price appreciation will decelerate over this period as supply catches up with demand tempered by rising mortgage rates and decreasing affordability.

Miami’s Massive Rental Market

Two-thirds of Miami residents rent, a rental rate rivaling that of New York City. This is partially due to the number of people working in seasonal and temporary jobs in the tourism business. It is partially due to the limited housing supply relative to demand. And it is partially due to the high cost of housing, even inland, relative to local wages. This is leading many investors in the Miami real estate market to buy single-family homes to be carved up into multiple units, each one rented out individually.

As the largest city in Florida, it would end up with multiple large universities for that reason alone. However, Miami’s international appeal and unique position have made it an education and research hub, resulting in the creation of institutions like Florida International University. There are almost forty colleges and universities within forty miles of Miami, hosting over 350,000 students. Ironically, Miami University isn’t among them – that’s in Ohio. The University of Miami, though, is located in Miami and enrolls more than 17,000 students.

Latest Miami Rental Market Trends

Around 70% of households in Miami are renter-occupied. As of April 2023, the average rent for a 1-bedroom apartment in Miami, FL is $2,700. This is a 7% increase compared to the previous year. Over the past month, the average rent for a studio apartment in Miami increased by 8% to $2,240. The average rent for a 1-bedroom apartment increased by 4% to $2,700, and the average rent for a 2-bedroom apartment increased by 4% to $3,500.

- The average rent for a 2-bedroom apartment in Miami, FL is currently $3,500. This is a 0% increase compared to the previous year.

- The average rent for a 3-bedroom apartment in Miami, FL is currently $4,500. This is a 7% increase compared to the previous year.

- The average rent for a 4-bedroom apartment in Miami, FL is currently $6,000. This is a 13% decrease compared to the previous year.

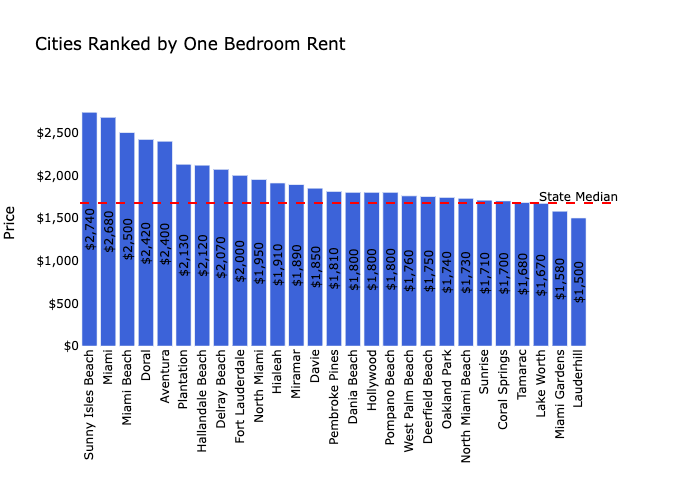

The Zumper Miami Metro Area Report analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Florida one bedroom median rent was $1,678 last month. Sunny Isles Beach was the most expensive city with one-bedrooms priced at $2,740. Lauderhill ranked as the least expensive city with rent at $1,500.

Here are the top cities in the metro area where rents are increasing. You can think of investing in these places because they have strong growth and demand for rental properties. You can also use their historical annual growth in rents to help predict future increases or decreases.

The Fastest Growing Cities in Miami Metro Area For Rents (Y/Y%)

- Hialeah had the fastest growing rent, up 25.7% since this time last year.

- Sunrise saw rent climb 23.9%, making it second.

- Miami Gardens was third with rent jumping 23.4%.

The Fastest Growing Cities in Miami Metro Area For Rents (M/M%)

- Hialeah had the largest monthly rental growth rate, up 6.1%.

- Plantation rent increased 3.9% last month, making it second.

- Miami was third with rent climbing 3.1%.

The Strong ROI for Landlords

Investing in the Miami real estate market can give you strong returns. The high demand for properties in southeastern Florida relative to demand limits the ability of people to buy, creating a large pool of renters. Miami ranked second in the nation for the most cost-burdened renters in the country, paying more than half of their income in rent. Rents aren’t as high as they are elsewhere in the country, but given the lower property values than markets like Silicon Valley or NYC real estate market, it is a good ROI. For example, the median home price is around $350,000, while the median rent is $1900 a month.

A $1900 a month rent would be considered a burden for a household earning $70,000 a year, while median incomes in the area are $50,000. Whether you’re renting to students, low-income workers, or snowbirds, potential investors in the Miami housing market will be glad to know this is a landlord-friendly market. Florida doesn’t have laws on rent control. Security deposits aren’t capped, and you can start eviction if the rent is three days late. Damage to the property requires a seven-day conditional quit notice, while repeated lease violations allow for a seven-day unconditional notice.